发布时间:2018-09-29 阅读量:

1)意大利VAT申请表Italian VAT application form

2)营业执照及英文翻译件(翻译公司盖章,翻译人签字)Certified copy of company certificate

3)法人身份证及英文翻译件(翻译公司盖章,翻译人签字)或法人护照(无需翻译)Copy of passport/ID of director

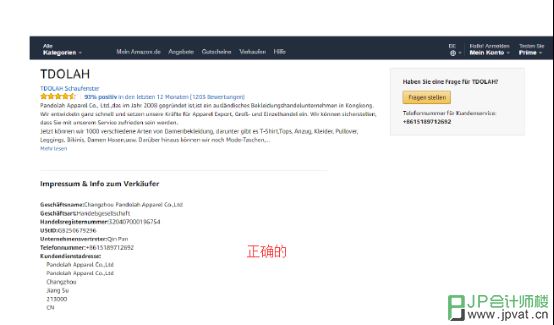

4)卖家账户信息(公司名和地址)

例如亚马逊账号可提供这个页面截图:

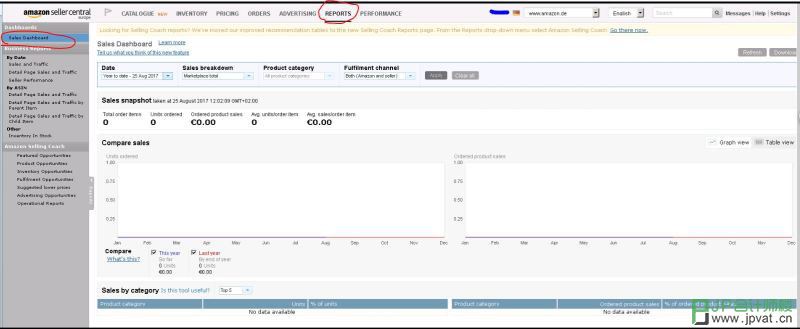

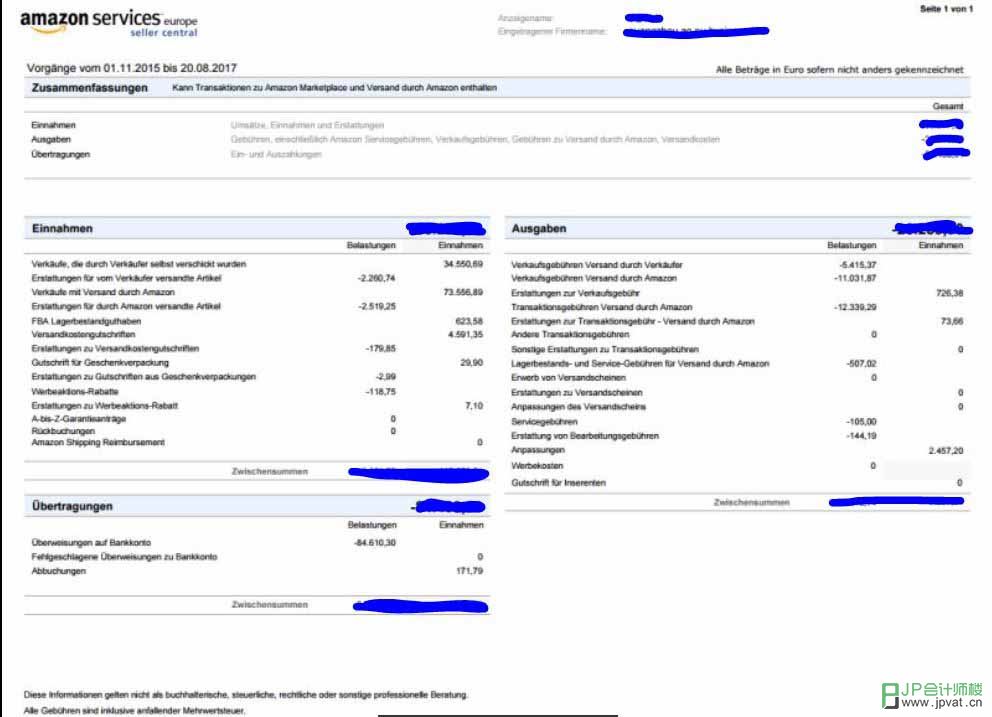

5) 若已经在意大利进行销售,需提供亚马逊、eBay、或其他在线平台销售网站的销售记录 Sales records of Amazon/Ebay/your own website in Italian(include Sale dashboard, vat transaction report and Summary report)

a)站点从开始到现在的vat transaction report ——提供Excel文件即可(若无销售,请提供无法下载VAT transaction report的截图证明)

b)站点从开始到现在的销售额截图sales dashboard——在business report里查询(即使没有销售也需要截图证明之前销售为零)

C)站点从开始到现在的Amazon Summary report

下载路径:Reports→Payments→Date Range Reports→Generate Report→Summary

6)最新版的英国或欧洲其他国家的VAT证书(如果有) UK VAT Certificate (Most updated version)

7)若股东大于一人需提供公司股东控股报告——在公司章程里有, 需提供扫描件及英文翻译件(翻译公司盖章,翻译人签字)Company Equity report of shares held by shareholders (if more than one share- holder)

8)法人签名盖章的一系列授权协议 (由JP提供)Original signed & stamped VCE POA – VAT IT ITALY S.r.l._Italian POA EU Business, ANR3 Form , AUTOCERTIFICAZIONE and VIES-Annex C

9)在意大利经营的地址(如果是在亚马逊平台销售,告诉是哪个平台即可;如果有意大利实体经营地址则需另外提供) The address which business will be carried out in Italy

以上信息全部需要,并需要提供:

All above documents are required, and also

1)香港公司需要出示CR、 BR BR(Business Registration)& CR(Company corporation)

2)NNC1公司注册法团成立表格(用于证明法人已被授权) a form NNC1 is needed for prove of authorisa- tion of the company director &

3)持续经营证明(英文) Continuing registration document

除了在意大利经营的地址以上信息全部需要,另需提供公司注册声明报告以及CT-UTR号码。All above documents are required except for the the address which business will be car-ried out in Italy, also an incorporation statement form and CT-UTR is required.

A Form 6166 is needed, if not possible, A Form 1120 can be replaced. 美国注册公司需 要Form 6166, 若无法提供,请提供Form 1120, 缺少这些文件申请无法继续。

Please note the Tax office may require additional information during registration

请注意,申请过程中当地税务局可能会要求提供更多信息

Please note that we offer a shortcut to apply VAT in Italy which is no need Notarial Certificate of Company, but need pay security deposit under the accountant’s bank. The amount is one month VAT of company. The security deposit will be returned after the resolution of the fiscal representative agreement and after Italian fiscal agency declares a full VAT compliance status. 请注意,我们提供在意大利申请VAT的捷径,需要在会计师银行下缴纳保证金。金额是公司一个月的VAT税金。保证金将在财务代表协议解除后以及意大利税局宣布公司VAT持续缴费状态后予以退还。

(一个月的VAT税金按过往12个月的月平均VAT税额计算,提交过往销售数据后由会计师计算后确认;如未开始销售,保证金为预计未来一年的月平均VAT税额,由会计师核算后确认)